CREDIT REPORT: MAIN SECTIONS OVERVIEW

Main Sections of Your Credit Report

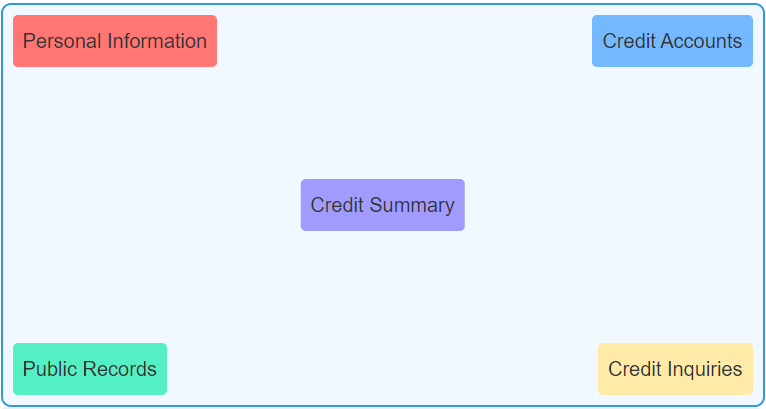

Understanding the Main Sections of Your Credit Report

A credit report is a detailed document that provides a comprehensive overview of your credit history. It’s crucial to understand each section to effectively manage your credit and identify areas for improvement.

Let’s explore the main sections you’ll find in a typical credit report:

5 Sections of a Credit Report

1. Personal Information

This section includes your identifying details such as name, current and previous addresses, Social Security number, date of birth, and employment information. It’s crucial to verify the accuracy of this information as errors could indicate identity theft or mixed files.

2. Credit Accounts (History)

Often the largest section of your report, this lists all your credit accounts, including credit cards, mortgages, auto loans, and personal loans. For each account, you’ll typically see the creditor’s name, account number, opening date, credit limit or loan amount, current balance, and payment history.

3. Public Records

This section includes public financial records such as bankruptcy, tax liens, or civil judgments. These entries can significantly impact your credit score and typically remain on your report for 7-10 years.

4. Credit Inquiries

This section shows who has accessed your credit report in the last two years. It’s divided into hard inquiries (when you apply for credit) and soft inquiries (like pre-approved offers or your own credit checks). Only hard inquiries can affect your credit score.

5. Credit Summary

While not always present, some reports include a summary section that provides an overview of your credit accounts, including total balances, credit limits, and payment history. This can give you a quick snapshot of your overall credit picture.

PRO TIP: Regular Review

Make it a habit to review your credit report from all three major bureaus (Equifax, Experian, and TransUnion) at least once a year. This helps you catch and address any errors or fraudulent activity promptly.

Next Steps in Understanding Your Credit

Now that you’re familiar with the main sections of a credit report, it’s important to learn how to interpret the information within each section and what it means for your overall credit health.

Need Help Improving Your Credit?

Understanding your credit report is the first step in improving your credit. If you’ve identified areas for improvement, we’re here to help guide you through the process.