CREDIT REPORT INTERPRETATION: MAIN SECTIONS Detailed

How to Interpret Your Credit Report

Understanding the Details of Your Credit Report

Now that you’re familiar with the main sections of a credit report, let’s dive deeper into interpreting the information within each section. Understanding these details is crucial for managing your credit effectively and identifying areas for improvement.

5 Sections of a Credit Report

1. Personal Information

While this section might seem straightforward, it’s important to review it carefully:

- Names: Look for variations of your name or names you don’t recognize. Multiple names could indicate mixed files or identity theft.

- Addresses: Verify all listed addresses. Unknown addresses could be a red flag for fraud.

- Employment: This information doesn’t affect your credit score but should be accurate.

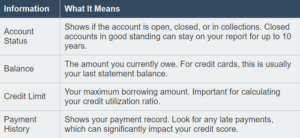

2. Credit Accounts (History)

This section provides a wealth of information about your credit habits:

Pay special attention to your credit utilization ratio (balance/limit) for revolving accounts like credit cards. Keeping this below 30% is generally good for your credit score.

3. Public Records

This section can have a severe impact on your credit:

- Bankruptcy: Chapter 7 bankruptcies stay on your report for 10 years, Chapter 13 for 7 years.

- Tax Liens: Paid tax liens can remain for 7 years from the payment date.

- Civil Judgments: These should no longer appear on credit reports as of 2017, but if you see one, dispute it.

4. Credit Inquiries

Understanding the two types of inquiries is crucial:

- Hard Inquiry: These occur when you apply for credit and can slightly lower your score. They stay on your report for 2 years but only impact your score for about 12 months.

- Soft Inquiry: These don’t affect your score and are not visible to potential lenders. They include checks you make on your own credit or pre-approved offers.

5. Credit Summary

While not always present, some reports include a summary section that provides an overview of your credit accounts, including total balances, credit limits, and payment history. This can give you a quick snapshot of your overall credit picture.

PRO TIP: Credit Score Factors

While interpreting your report, keep in mind the factors that influence your credit score:

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit Inquiries (10%)

Watch Out For This:

- Accounts you don’t recognize (potential identity theft)

- Late payments you believe were on time

- Incorrect balances or credit limits

- Accounts that should have aged off your report

Ready to Take Action

After interpreting your credit report, you may find areas that need attention.

Here are some next steps:

- Dispute any errors you find with the credit bureaus

- Set up payment reminders to avoid future late payments

- Work on reducing high credit card balances

- Consider a credit-builder loan or secured credit card if you need to establish credit

Need Help Improving Your Credit?

Understanding your credit report is the first step in improving your credit. If you’ve identified areas for improvement, we’re here to help guide you through the process.