Understanding Your FICO Score

The Truth about FICO Scores!

Discover how FICO Scores impact your financial future.

What they’re not telling you!!!

Learn the secrets of different types of FICO scores and how some creditor’s “buyers of credit bureau data and information” might not use the standard FICO Score 8 and much more.

About FICO

Fair Isaac Corporation (FICO), originally known as Fair, Isaac and Company, is a data analytics company based in Bozeman, Montana. Founded in 1956 by engineer William R. “Bill” Fair and mathematician Earl Judson Isaac, FICO is a global leader in credit scoring services. Their FICO score, a measure of consumer credit risk, has become a fixture in the United States’ consumer lending landscape. Lenders use FICO scores to assess borrowers’ creditworthiness.

What Is a FICO Score?

A FICO score is like your financial report card. It’s a three-digit number (ranging from 300 to 850) that shows how well you manage credit. Lenders use it to see how responsible you’ve been with borrowed money based on your credit reports.

Think of it “simply”, as your credit grade!

How Is It Calculated?

- Payment History: Did you pay your bills on time? This matters a lot!

- Credit Utilization: How much of your available credit are you using? Keep it low.

- Length of Credit History: A longer credit history is better.

- New Credit: Avoid opening too many accounts at once.

- Credit Mix: Having different types of credit (like credit cards and loans) helps.

FICO Score Ranges:

- 300–579 (Poor): High risk. Lenders might hesitate to lend to you.

- 580–669 (Fair): Some risk. Work on improving!

- 670–739 (Good): Solid credit. Most lenders like this range.

- 740–799 (Very Good): Excellent! You’re in good shape.

- 800–850 (Exceptional): Top-notch! Best rates await you.

FICO SCORE RATING

Key Features of FICO Scores

Comprehensive Credit Evaluation

FICO Scores provide a thorough assessment of your creditworthiness, helping lenders make informed decisions.

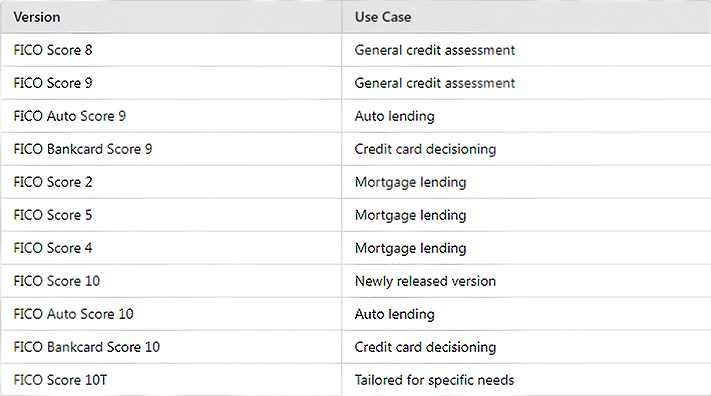

Multiple Score Versions

Understand the different FICO Score versions and how each one affects your credit profile.

Widely Accepted

FICO Scores are used by 90% of top lenders, making them a critical factor in loan approvals.

Predictive Power

FICO Scores accurately predict credit risk, helping you manage your financial health effectively.

Types of FICO Scores

How Different FICO Scores Impact You

FICO Scores come in various versions, each tailored for specific types of lending, such as mortgages, auto loans, and credit cards. Understanding these scores can help you better navigate your financial landscape.

Why FICO Scores Matter

Third-party buyers, such as lenders and financial institutions, use FICO Scores to assess credit risk and make lending decisions. Knowing how these scores are used can empower you to improve your financial standing.

- Loans: Lenders use your FICO score to decide if they’ll give you a loan (like for a car or house).

- Interest Rates: A higher score means lower interest rates. Save money!

- Renting: Landlords check your score before renting to you

- Job Prospects: Some employers look at it too.

Remember, your FICO score reflects your credit health. Keep it high by paying bills on time and using credit wisely!

Why FICO is the Most Important Score

The FICO Score is widely regarded as the most important credit score because it is used by 90% of top lenders. This score plays a crucial role in determining an individual’s financial standing, influencing everything from loan approvals to interest rates. A high FICO Score can open doors to better financial opportunities, while a low score can limit access to credit and increase borrowing costs. Understanding your FICO Score and how it is calculated is essential for maintaining good financial health.

The Top Lenders (90%)

Regarding FICO scores, the top lenders—those who use them most—are like the VIPs of the credit world. They’re the ones who decide whether to lend you money or give you that shiny new credit card. So, who are they?

Mortgages

When you’re house-hunting and need a mortgage, pay attention! Fannie Mae and Freddie Mac, big players in the mortgage game, rely on FICO scores. They’re like the wise old owls of home loans.

Car Loans

Zooming into auto loans, FICO 8 and 9 scores take center stage. These scores are still widely used by car lenders. So, when you’re eyeing that sleek ride, FICO’s got its calculator out.

Credit Cards

Credit cards? Oh, yes! FICO has a special score dance for credit card issuers. They’ve got their own set of scores, fine-tuned for plastic magic. It’s like FICO’s secret handshake with the credit card world.

How Lenders Use FICO Scores

Lenders rely heavily on FICO Scores during the loan application process to assess an applicant’s creditworthiness. These scores help lenders evaluate the risk of lending money to a borrower. A higher FICO Score indicates a lower risk, making it more likely for the applicant to receive favorable loan terms, such as lower interest rates and higher credit limits. Conversely, a lower score may result in higher interest rates or even loan denial. Therefore, maintaining a good FICO Score is essential for securing the best possible loan conditions.

Advantages and Disadvantages of the FICO Score System

The FICO Score system offers several advantages, including its widespread acceptance and standardized approach to evaluating credit risk. It provides a clear and consistent metric for both lenders and consumers, making it easier to understand and manage creditworthiness. However, there are also disadvantages, such as the potential for errors in credit reports that can negatively impact scores. Additionally, the system may not fully capture the financial behaviors of all consumers, particularly those with limited credit histories. Despite these drawbacks, the FICO Score remains a vital tool in the financial industry.

Take Charge of Your Financial Future

Don’t wait to start your journey towards better financial health. Are you not sure, still deciding? Partner with our trusted affiliates to repair your credit score and achieve your financial goals. Consistent action is key to success. Take the first step today!