Credit Reports: All 3 Major Bureaus

Access Credit Reports from All Three Bureaus

Introduction

This is where theory ends and action begins. Your credit report is the single most important document in your financial life. We will show you exactly how to get it, read it, and turn it into your personal roadmap to a higher score.

Access Credit Reports: How to Get Your Full Credit Picture — for Free

Why This Matters

Feeling overwhelmed by your credit situation? The very first step to taking back control is getting a clear picture of what lenders see. This isn’t about judgment; it’s about empowerment.

By law, you’re entitled to one free credit report from each of the three major credit bureaus. This guide will walk you through the safe, legal, and free way to get your official reports from all three major bureaus: Equifax, Experian, and TransUnion, and ensure you know exactly how to use them.

Your Primary Guide: How to Get Your Official Reports for Free

Step-by-Step Walkthrough

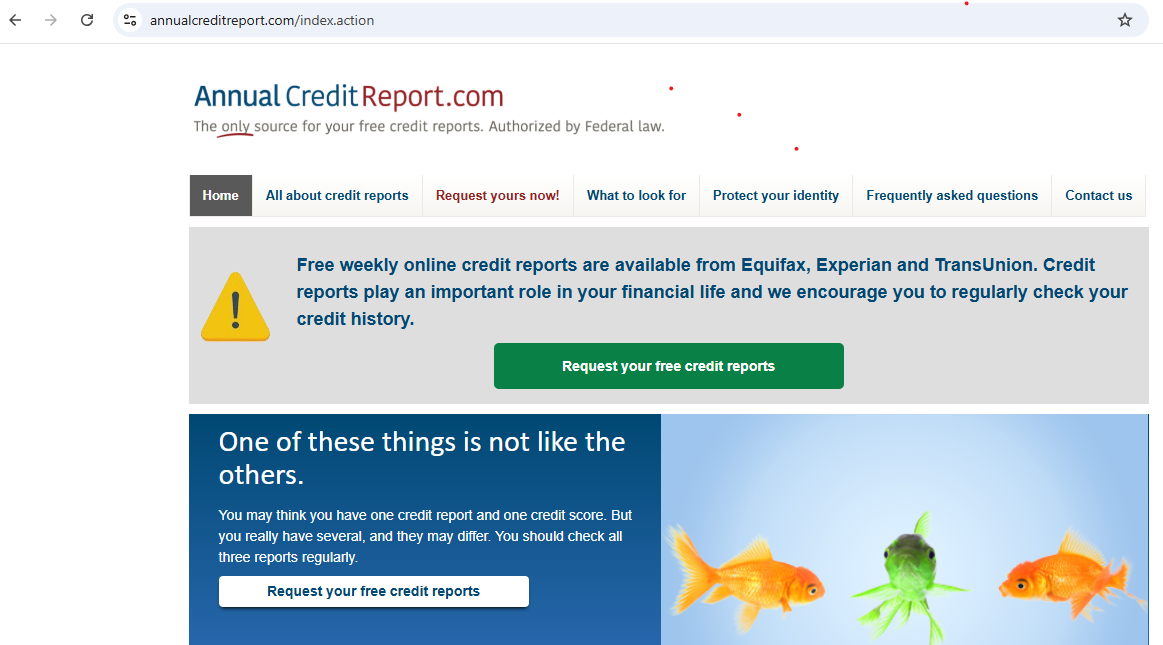

Step 2: Click “Request your free credit reports”

You’ll need:

- Full legal name

- Date of birth

- Social Security Number (for identity verification)

- Current address & Previous address (if you’ve moved in the last two years)

Tip: This site uses high-grade encryption and is government-authorized. Your information is safe.

Step 4:

Each bureau will ask you 3–5 multiple-choice questions based on your credit history (e.g., past loan amounts, old addresses)

Answer carefully – even one wrong answer can result in a denial for online access. If you’re denied, you’ll be offered instructions to request by mail, which is a safe alternative.

Step 5:

Each bureau will ask you 3–5 multiple-choice questions based on your credit history (e.g., past loan amounts, old addresses)

You can select one, two, or all three reports. For a complete picture, it’s best to get all three at once.

Crucial Step: How to Save Your Reports as PDFs

Your reports will not be saved online. You must save them immediately.

Look for a “Save” or “Print” button. In your browser’s print options,

** Save each report with a clear name:

- Equifax_Report_July2025.pdf

- Experian_Report_July2025.pdf

- TransUnion_Report_July2025.pdf

Back them up! Email the files to yourself or save them to a secure cloud service like Google Drive or Dropbox.

Other Ways to Access Your Credit Information

While official reports are for deep analysis, free monitoring services are great for tracking changes.

| Platform | Score Type | Access to Reports? | Best For… |

|---|---|---|---|

| Credit Karma | VantageScore | Partial (2 bureaus) | Weekly trend tracking & seeing changes |

| Experian.com | FICO + Report | Yes (Experian only) | Getting a free, real FICO score |

| Credit Sesame | VantageScore | Summary info only | Quick glances at your score & debt |

Important Distinction: These services show VantageScores and partial report data. They are excellent for monitoring but are not a substitute for your official reports when disputing errors.

Disclaimer: These are paid services. We strongly recommend using the free method above first. These links are for users who have a specific need for an additional paid report outside the free annual allowance.

- Purchase a Single Report from Equifax

- Purchase a Single Report from Experian

- Purchase a Single Report from TransUnion

Start a “Credit Repair Folder” or digital folder on your computer now. Place your saved PDF reports inside. Organization is half the battle, and you’ve already won the first part.

Conclusion: Use the Right Tool for the Right Job

As we’ve just covered, you now have two distinct types of tools. Think of your official report from AnnualCreditReport.com as the foundational blueprint, used for deep analysis and legal disputes. The free monitoring services, like the ones detailed in the table above, are your daily dashboard—perfect for watching for sudden changes and tracking your progress. Use both correctly, and you’ll have a complete command center for your credit health.