FICO Score's: Predictive Power

The Predictive Power of FICO Scores

A Deeper Dive to FICO Score.

FICO Scores are renowned for their ability to predict credit risk and future financial behavior. This predictive power is what makes them invaluable to lenders and financial institutions across the globe. Let’s dive into what makes FICO Scores so predictive and how this impacts consumers and lenders alike.

Key Aspects of FICO Score Predictive Power

Features:

- Highly correlated with future credit performance

- Based on extensive historical data analysis

- Continually refined using machine learning and AI

- Predictive across various types of credit products

- Helps lenders assess risk more accurately

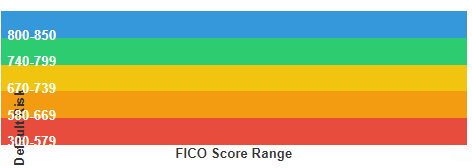

Visualizing FICO Score Predictive Power

- This chart illustrates how default risk correlates inversely with FICO Score ranges. Higher scores predict lower default risk, while lower scores indicate higher risk.

Factors Contributing to FICO Score's Predictive Power

- Historical Data Analysis: FICO uses vast amounts of historical credit data to identify patterns and trends in consumer behavior.

- Multiple Data Points: The score considers various aspects of a person’s credit history, providing a comprehensive view of creditworthiness.

- Weighted Factors: Different aspects of credit history are weighted based on their predictive strength, enhancing overall accuracy.

- Continuous Refinement: FICO regularly updates its scoring models to maintain predictive power as consumer behavior and economic conditions change.

- Industry-Specific Models: FICO develops specialized scores for different industries, further improving predictive accuracy for specific types of credit.

Key Aspects of FICO Score Predictive Power

- Default Risk: Higher scores correlate strongly with lower likelihood of serious delinquency in the next 24 months.

- Payment Behavior: Scores can predict the likelihood of consistent, on-time payments.

- Credit Utilization: Lower scores may predict higher credit utilization and potential overextension.

- New Credit Seeking: Certain score patterns can indicate increased likelihood of opening new credit accounts.

- Long-term Credit Management: Scores can predict a consumer’s ability to manage various credit products over time.

Impact of Predictive Power on Lending Decisions

The strong predictive power of FICO Scores influences lending in several ways:

- Enables risk-based pricing, where better scores can lead to better rates

- Allows for faster credit decisions through automated underwriting

- Helps lenders set appropriate credit limits

Assists in portfolio management and risk assessment - Facilitates development of pre-approved credit offers

Limitations and Considerations

While highly predictive, it’s important to note some limitations:

-

-

- Scores don’t predict specific life events that may affect creditworthiness

- They don’t account for income or assets, which are also important in lending decisions

- Predictive power can be affected by “thin” credit files with limited history

- Scores may not fully capture alternative financial behaviors not reported to credit bureaus

-

The Future of FICO Score Predictive Power

FICO continues to enhance the predictive power of its scores:

- Incorporation of alternative data sources to improve predictions for consumers with limited credit history

- Advanced analytics and machine learning to identify subtle patterns in credit behavior

- Development of scores that predict specific outcomes (e.g., likelihood of mortgage default)

- Exploration of real-time data usage to provide more current risk assessments

What This Means for Consumers

- Understanding the different FICO Score versions is important because:

- Recognize the importance of maintaining a good credit score

- Understand how their current credit behaviors may affect future credit opportunities

- Make informed decisions about credit use and management

- Prepare more effectively for major financial decisions like applying for a mortgage